property tax attorney houston

Start saving taxes now. For a tax lien to be recorded for the previous tax year the filing must be received by the department by midnight on June 30.

Cantrell Cantrell Pllc Home Page Texas Tax Attorneys

Our network attorneys have an average customer rating of 48 out of 5 stars.

. A Rundown on Veterans Property Tax Exemptions by State. Paying your property taxes is no easy feat. The Houston County Board of Tax Assessors Office should be contacted for more information on property values.

The phone number for the Tax Assessor is 478-218-4750. Our entity-structuring advice is designed to achieve minimize liability maximize anonymity deter lawsuits and insulate assets from judgments. Other Property Tax Exemptions in California.

A property easement grants someone else the limited right to use your land for a specific purpose. Get the right guidance with an attorney by your side. We are your trusted Dallas tax attorney when looking for assistance with a variety of issues.

California counties offer other property tax exemptions. Main residence The exemption applies to the first 7000 of the homes value from property tax. The tax help we provide in Dallas or Fort Worth includes.

Valuation of Closely Held Businesses. Business Valuation State Bar of Texas Family Law Webcast Dallas Texas. We offer property tax relief to help you avoid penalties collection fees or foreclosure.

To check department records for tax liens you may view homeownership records online or call our office at 1-800-500-7074 ext. A tax lien sale is when the liens are auctioned off to. Filing a property tax return homestead exemptions and appealing a property tax assessment.

State of Georgia government websites and email systems use georgiagov or. Effective for tax year 2019 persons with a residence homestead are entitled to a 5000 exemption of the assessed valuation of their home. There are two types of tax sale homes.

Unless you live in states with low property taxes such as Alabama Hawaii and West Virginia you may need help covering your tax bills. Contact us to learn more today. The Houston County Tax Commissioners Office should be contacted for more information on inquiries about billing and collection of property taxes.

Additional information can be found in the Code of Alabama 1975 in Title 40 Chapter 10 Sale of Land. Follow the instructions or seek some help with our property tax consultant experts. Learn how to protest property tax in Harris County.

The City of Shenandoah announced it intends to adopt the no-new-revenue rate of 01477 per 100 of valuation during an Aug. Every effort has been made to include information based on the laws passed by the Georgia Assembly during the previous session. For further details please review the Tax Lien Filing Instructions provided below.

Federal Multi-state and Advocacy Update State Bar of Texas Webcast 2007. The property tax rate change will be the first since 2018. The over-65 exemption is for property owners who are 65 years of age or older and claim their residence as their homestead.

For example a common easement is one that a utility company has for placing cables pipes or other equipment. Pursuant to Texas Occupations Code chapter 1201206 g and Texas Property Tax Code section 3203 a-2 a person may not transfer ownership of a manufactured home until all recorded tax liens have been released and all taxes which accrued within the 18 months preceding the date of the sale have been paid. If you or your loved one is a veteran you may qualify for a partial or full property tax exemption.

The best way to deter litigation in Texas is to have an asset protection structure in place before trouble starts. Our tax resolution attorneys cater to everyone from individual taxpayers to multi-million dollar corporations helping them avoid the traps pitfalls and numerous complexities of the IRS tax system. Veterans The following resident categories can apply for up.

Family transfers Citizens who buy a property from their parents or kids dont have to schedule a full reassessment. It is advisable to consult a competent attorney regarding your contemplated purchase of tax delinquent property. Used in combination with a living trust.

Moderator Family Law Practice. Inquire about our recommended two-company LLC structure for real estate investors. The phone number is 478 542-2110.

Tax lien sale homes and tax deed sale homes. Our breakdown of veterans property tax. Tax Ease is one of the top lenders for Texas Property Tax Loans for both commercial and residential properties.

Both represent sales of homes with unpaid property taxes. The City offers three property tax exemptions to property owners. The gov means its official.

Local state and federal government websites often end in gov. Neither an assignment nor a tax deed gives the holder clear title to the parcel. This section provides information on property taxation in the various counties in Georgia.

Gonzalez an attorney by trade claimed the exemption on his McAllen property currently worth 527054 while his wife claimed the exemption on a second property in the city valued at 287131. Search Tax Delinquent Properties. Appear at 13013 Northwest Fwy Houston TX 77040 on the date time specified to meet with an.

Alissa Gipson Tax Attorney Chamberlain Hrdlicka Attorneys At Law Mid Market Multi Service Law Firm With Nationally Leading Tax Lawyers

Property Tax Consultants Property Tax Attorney Houston Tx

Taxes Too High Here S How To Protest Your Texas Property Appraisal

Are You Paying Excessive Property Taxes Our Chicago Property Tax Attorney Will Fight To Reduce Your Taxes To The Minimu Tax Attorney Tax Lawyer Attorneys

Practical Tips To Win Your Property Tax Protest In Houston Steph Stradley Blog

Delinquent Property Taxes Houston Tax Foreclosure Jarrett Law Firm Pllc

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Ad Valorem Property Tax Attorney Reducing Property Taxes For Businesses

![]()

Delinquent Property Taxes Houston Tax Foreclosure Jarrett Law Firm Pllc

Property Tax Appeal Propertytaxes Law

Harris County Property Tax Help Home Tax Solutions

Texas Property Tax Disputes Capabilities Vinson Elkins Llp

Assistance With Texas Property Tax

Ad Valorem Property Tax Attorney Reducing Property Taxes For Businesses

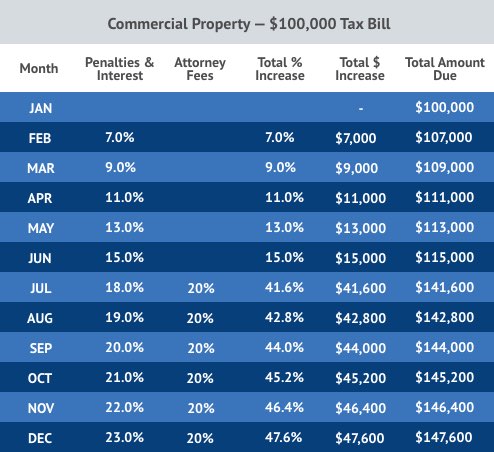

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Company Leadership Includes Highly Tenured Team

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Do You Need A Property Tax Attorney Or Consultant Propertytaxes Law